Frequently Asked Questions

Please see the link to the National webpage below - Funding arrangements for the payment of relocation and expenses

Please read the Policy for the Reimbursement of Removal or Rotational Travel Expenses for Doctors in Training prior to filling in your application as it is the trainee's responsibility to check their eligibility prior to submitting a claim.

How to apply:

- Download and complete the application form available on the following webpage: https://heeoe.hee.nhs.uk/app_eligibility_to_claim_form

- Send this to medical staffing at your employing Trust for processing with any supporting evidence/receipts. Trust contacts can be found here: https://heeoe.hee.nhs.uk/Trust_Contacts_Relocation

- The employing NHS Trust will process your claim and inform you of the outcome.

- If your application is approved you will need to claim reimbursement from your employing trust within 28 days of receiving your outcome.

- If your application is declined and you feel is has been processed incorrectly of unfairly, the appeals procedure to follow is available in the policy.

Applications for expenses need to be submitted before on within 2 months of incurring the costs and you will only need to apply once for the duration of your post (up to 12 months).

If your post is extended or changed in any way you will need to submit a new application following a change of circumstances for eligibility to be reviewed, this also applies to trainees who reach their approval limit or approval date and require further expenses.

Please see table below for examples of application deadlines:

|

Claim Type: |

Post start date: |

Date costs incurred: |

Application deadline: |

|

Excess Travel |

4th August 2021 |

First day of commute (4th August 2021) |

5th October 2021 |

|

Continuing Commitments |

4th August 2021 |

Rent paid from 25th July 2021 |

25th September 2021 |

|

Relocation of property (Rented – Rented or Sale/Purchase) |

3rd September 2021 |

12th August 2021 – 9thSeptember 2021. Multiple expenses. |

9th November 2021 (Two calendar months from final cost incurred) |

|

Travel in lieu of relocation |

1st September 2021 |

First day of commute (1st September 2021) |

1st November 2021 NOTE: New app to be submitted once relocation has taken place. |

Paper applications cannot be accepted because all trainee information and correspondence relating to relocation is stored on an electronic database, printing or scanning your application will also invalidate the digital ID (signature) required and deem the form invalid.

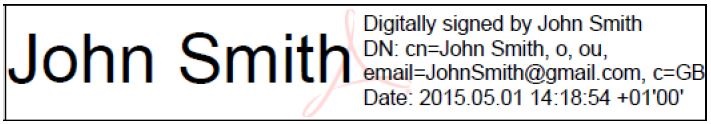

All signatures are now required in the digital ID format so documents can be verified, these signatures contain hidden information detailing by who and when the signature was placed and confirms the document has not been altered in any way. Any forms signed incorrectly will invalidate the form and a new application will need to be completed. Forms submitting that are missing the Digital ID will not be processed and no outcome will be provided.

How your digital ID should look:

Guidance on how to set up and input a digital ID can be found here: https://heeoe.hee.nhs.uk/sites/default/files/instructions_for_placing_a_digital_id_0.pdf

Claims of up to £10,000.00 can be made from FY1 to CCT (Certificate of Completion of Training) per trainee household when the eligibility criteria provided in the policy is met. Trainees on a Foundation Programme may claim up to £2000.00 of the overall £10,000.00 maximum sum during their foundation training years (FY1 and FY2).

As part of establishing your eligibility to claim it must be confirmed the new claim does not exceed this limit, therefore it is the trainee’s responsibility to include any previous relocation reimbursements from FY1 onwards for all members of the household and inclusive of all HEE regions.

For information on previous claim amounts please contact medical staffing at your previous employing NHS Trust(s) who will be able to provide this information, it is advisable to document any correspondence as this may be needed as evidence to support your claim.

Once the application form has been filled in it must be submitted to the employing NHS Trust, the Employer and HEE reserves the right to request further evidence from trainees during processing and if required it will be requested by an administrator.

If approved all original receipts/invoices for all costs will be required by the employer in order to reimburse the expenses. If these are not provided upon request the costs cannot be reimbursed.

HEE will provide recompense for excess mileage expenses (payable at the reserve/PTR rate) incurred as a result of rotation when their home to place of work is more than 17 miles each way. Trainees appointed to single-site training programmes are not eligible to claim excess mileage as they are expected to live within a reasonable commute (less than 20 miles) of the place of work.

The mileage costs that may be paid under these circumstances is the mileage from home to the place of work less 17 miles (trainees are not eligible for reimbursement of mileage costs for the first 17 miles of their journey as this is not defined as ‘excess travel’).

Trainees would not be eligible to claim for relocation expenses and excess travel during the same post. If reimbursed for a move, it is expected that your new property is conveniently located for your new post in order not to require assistance for excess travel. A trainee that chooses not to relocate but to travel the greater distance to the new place of work may apply for excess travel expenses.

Junior Doctors that have moved over to the new 2016 contract will be reimbursed at a rate of 28p per mile.

Junior Doctors on a previous contract will be reimbursed at the public transport rate of 24p per mile.

All travel is calculated using AA route planners shortest route.

Three written competitive quotations must be obtained in order to claim for reimbursement of removals, trainees may choose to use a more expensive removals company but reimbursement will be limited to the lowest quote.

If three quotes are not provided removals expenses will not be approved.

When the trainee has sold the previous residence in order to relocate to the new area of employment, the policy reimburses fees relating to the purchase of the house on a ‘‘broadly comparable standard’ (in terms of present housing arrangements, i.e. rented or property owner, number of rooms, semi-detached) to that occupied in the area of previous employment.’

In order to be eligible the previous residence must have been occupied by the trainee and be (or in the process of being) sold.

Stamp duty is only eligible for reimbursement when the previous property has been sold, in order to purchase a new property in the area of new employment.

The policy does not reimburse expenses incurred due to the purchase of additional properties.

All expenses and fees stated on your form will require supporting evidence/receipts.

The policy reimburses additional accommodation costs when trainees have no choice but to relocate for their training programme and for good reason cannot relocate their entire household, or are in the process of selling and buying a property and may be incurring the costs of two rent/mortgage payments for a short period of time. If the permanent residence is outside the East of England, it is expected that the intention is to relocate that residence to the area in which training and employment has been accepted. If there is no intention to relocate the permanent residence to this region then the cost of an additional property would remain that of the owner/tenant.

Continuing commitments cannot be claimed if the trainee only has one monthly rent/mortgage out-going.

Unfortunately junior doctors in LAT/LAS posts are not eligible to claim for reimbursement of removal or rotational travel expenses. Trainees must have applied for and been successfully appointed to a rotational training programme and been issued with a National Training Number (NTN) in order to be eligible for a claim.

If you have any queries regarding tax you will need to speak directly to your employer and/or HMRC as none of the team at Health Education England, East of England are qualified to provide advice on tax or national insurance contributions.

According to HM Revenue & Customs “if your employer helps you to move home because of your job, any payments you receive, or any goods or services provided for you, are treated as part of your earnings for tax and national insurance contribution [NICs] purposes. However, the first £8,000 of any help you get from your employer is exempt from tax and NICs as long as certain conditions are met”.

Claims for excess travel and continuing commitments may be liable to tax and national insurance.

Trainees that voluntarily leave their Training Programme before the Certificate of Completion of Training (CCT) date will be required to repay a proportion of their relocation expenses.

This is calculated using the following sliding scale:

|

If Trainee Leaves |

Percentage of Costs reimbursed by HEEoE to be Reclaimed |

|

Within 6 months |

75% |

|

Within 6 – 24 months |

50% |

|

24+ months |

25% |

In order to request a change to your base place of work an electronic request form must be downloaded, completed, and submitted to Health Education England, East of England. The request must contain evidence confirming the second or subsequent post, either from the Recruitment Team of Training Programme Director. The base change request form and full guidance can be found here: https://heeoe.hee.nhs.uk/base_change_request

In the eventuality that all of the excess costs cannot be covereded by the policy, leaving a trainee in severe financial difficulty there are a number of charities, approved by HEE, available to provide assistance.

Please see below, links to a number of charities which maybe of use:

Royal Medical Foundation

T: 01372 821010

W: www.royalmedicalfoundation.org

E: rmf-caseworker@epsomcollege.org.uk

StepChange Debt Charity

T: 0800 138 1111

Royal Medical Benevolent Fund

T: 020 8540 9194

W: rmbf.org

Please be aware that these charities should not be used to cover the costs of all expenditures but only to cover costs that the relocation excess travel policy is unable to reimburse and leave the trainee in severe financial difficulty.

Under the HEE East of England Relocation Travel Expenses to be eligible trainees must be funded by the Postgraduate Dean an posses a National Training Number.

Unfortunately as MTIs do not fall under these criteria they are unable to claim under the East of England policy.

For trainees who commenced a HEE accredited training programme before August 2020, the information on this local webpage still applies for their current circumstances. For trainees looking to apply now or who have applied since commencing their HEE training programme in August, please visit the linked webpage: https://www.hee.nhs.uk/news-blogs-events/news/new-national-arrangements-payment-relocation-expenses-costs

Under the new national framework trainees will be able to claim up to £10,000 to cover relocation and excess mileage costs over the duration of their postgraduate training which will be fully funded by HEE.

Doctors who are working in a GP practice setting who are required to use their own vehicle for home visits, shall be reimbursed for the cost of mileage from home to the principal place of work, as well as any other associated allowances.

The Eligibility criteria for claiming this travel mileage cost are listed below:

• This provision is restricted to doctors working in GP practice(s) who are required to use their own vehicle for home visits when working in a GP practice placement only.

• This revised provision was agreed and implemented on 27 November 2020, therefore all claims can be made from this date onwards. Any claim(s) falling under this provision can be made where there is a clearly defined expectation that a home visit will be undertaken; plus, any associated allowances incurred through meeting this requirement.

• Reimbursement will need to take into account any excess mileage allowances paid to the doctor working in the GP practice under relocation policies. Doctors can submit claims for a single journey under both policies, however, doctors will not be reimbursed twice for the same mile travelled.

• The claims will cover the cost of home to place of work and return journey

• There is no cap on eligible mileage except where there is an interaction with excess mileage allowance provisions.

• The Reserve rate, of 28p per mile, will apply.

• There will be no deduction of normal commuting costs from value of mileage claims. Hence, reimbursement of claims will be treated as a taxable benefit.

Any further information including how to process claims can be found at national webpage here

There are two work schedule process listed below:

- Generic work schedule: The lead employer or host organisation shall provide the generic work schedule that sets out the pattern and days of work for a doctor working within a GP practice. The generic work schedule will form the basis of the personalised schedules. The generic work schedule or an alternative document will set out the number of expected visits required to be undertaken by a doctor. This will be confirmed by the educational supervisor in the personalised work schedule. The generic work schedule will also include other items such as the scheduled duties of the doctor that will form the basis for a work schedule. Any days that mileage is incurred on prior to the work schedule, or an alternative document, being issued is to be paid, unless a doctor has been informed at the start of their placement, by a member of practice staff, that they will not be required to perform home visits until further notice. This is because the doctor will have been required to bring their vehicle to work due to the possibility of being asked to undertake a visit.

- Personalised work schedule: It would be expected that the personalised work schedule reflects the opportunities for learning from home visiting. The GP practice, the educational supervisor and doctor will need to agree in the personalised work schedule which days there is an expectation to perform visits for the working week. The personalised work schedule must be agreed before or within four weeks after the commencement of the placement during scheduled hours of work. As per schedule 4, paragraph 30, an employer or practice may need to amend the specified home visit days within the doctor’s work schedule, in response to a change in the circumstances of the doctor, or service delivery needs. Where a home visit is undertaken which has not been included in a fixed work schedule or is over and above that agreed in a work schedule any such claims would need to be agreed locally and verified by the GP trainee supervisor or practice managers.

If a trainee is not able to drive home as it is deemed unsafe and they choose to stay in hospital accommodation they can no longer claim via T&R as done previously the Trust now be responsible for covering this cost as this is an employer’s responsibility with duty of care to employees.